Protests certainly weren’t the main culprit for the slowdown in economic growth in the first quarter of this year, but they exposed the fact that Serbia’s economic growth in recent years has been resting on increasingly weak foundations.

President Vučić was blaming protests for “scaring away investors and tourists” even before the data was released. It turns out that the protests indeed scared one investor – the state itself, because, in the President’s own words: “Now there isn’t a mother’s son who will sign any paper.” This is evident in government capital expenditures which, in the first quarter of the year – a quarter when acceleration of expenditures was expected primarily for Expo-related projects – actually fell by 3.7% in nominal terms, and by as much as 7.8% in real terms. Rapid government investments have served until now to maintain economic growth even as export growth slowed. It seems that President Vučić has finally exhausted the quick methods of boosting economic growth.

Growth Structure and Changes in FDI

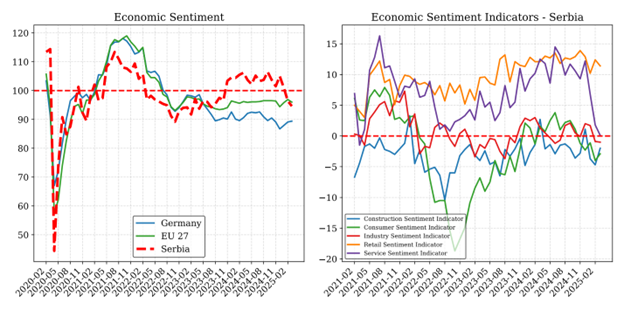

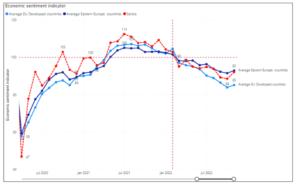

According to flash projections from the Statistical Office, GDP growth in the first quarter of this year compared to the first quarter of last year fell to 2.0%, versus expectations of 3.5%. These expectations took into account the exceptionally high base in the first quarter of 2023, while 4% was expected for the whole of 2025. The key contributor to this underperformance was the slowdown in public investments. There was also a slowdown in the inflow of foreign capital, which halved compared to the exceptionally high inflow in the first quarter of last year.

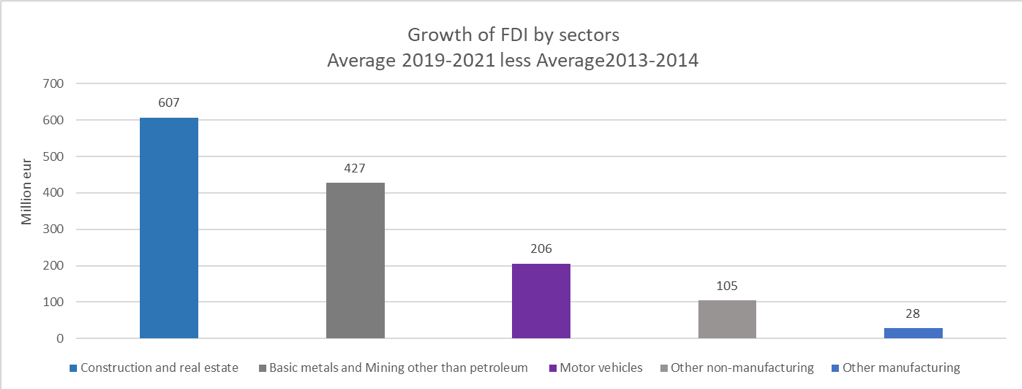

Serbia’s solid economic growth over the past years has so far been primarily associated with strong FDI inflows. Serbia stood out because, in the period from the pandemic to the end of 2024, these remained relatively high and stable (growing from €3.8 billion in 2020 to €5.2 billion in 2024). However, FDI is not a homogeneous category. During the observed period, their composition and perspective of contribution to sustainable development of the country changed significantly.

Frequent ribbon-cutting ceremonies in front of new, foreign, mostly German factories have accustomed the Serbian public to equate foreign investments with investments in manufacturing. These were primarily aimed at creating as many jobs as possible, which was indeed a priority at the beginning of this regime. FDI in export-oriented manufacturing appears beneficial also because it typically brings knowledge, technology, and generates foreign currency inflows. However, investments in manufacturing are just one component of FDI. They made up only 38% of the total in 2021 when they reached their peak in real terms (€1.5 billion). Since then, they have been declining, so that in 2024 they amounted to only €0.6 billion (11% of the total).

Since 2021, only FDI in mining has been growing steadily – doubling in each of the past two years, reaching €1.4 billion in 2024. Production and exports of ore and copper concentrates have also grown, which undoubtedly contributed to the overall measured GDP growth. However, given the lack of transparency in exploitation conditions, assessing the actual effect of this project on growth and development, especially compared to what might have been possible, would require a separate study. In any case, we have no doubt that this represents a missed opportunity. While copper prices on the global market are booming, with prospects for further long-term growth, Serbia’s mining royalties and negotiating power with China are low.

The largest component of FDI in 2024 (€1.5 billion) consisted of investments in the construction and real estate sector, whose contribution to GDP growth, and especially to foreign currency inflows after the investment period, is most questionable. Their actual amount is also questionable. On one hand, it is possible that in some cases, government borrowing through bilateral credit arrangements is first reflected in statistics as capital inflow from construction companies from the respective country, and only later as the Republic of Serbia’s debt. In that case, we’re not talking about an inflow of private, market-driven capital, but about Serbia’s public funds. It’s also likely that, in the context of corrupt activities, part of this money consists of “laundered” domestic capital, especially since the counterpart to this large item in the structure by country can mainly be seen in inflows from tax havens.

Exports – Crises and Opportunities

The trend in goods exports, especially manufacturing products, follows the described investment flows and has been contributing less and less to economic growth for some time. Since the reversal in the structure of FDI flows, its real growth has been halving in both 2023 and 2024, while in the first quarter of 2025 it even decreases in real terms, despite the growth in exports of ores and non-ferrous metals. The main “culprits” are, of course, difficulties in the European economy, primarily Germany. These have especially affected the part of Serbian exports included in the global value chains of the automotive and related industries, as well as those industries that rely most heavily on cheap labor. This has undoubtedly been contributed to by the fast growth of the “lowest” wages alongside the appreciation of the dinar.

Thus, during 2024, we witnessed a reduction in the number of employees in a significant number of foreign factories – for example, Yura, Mei Ta, as well as the closure of others – Adient, Siting (closed its facility). The decline in exports of these products in the first quarter of 2025 accelerated to €430 million, almost as much as in the entire 2024.

It’s clear that these investors aren’t packing up because of protests, but rather due to a longer-term and deliberate process. Even as such, their departure is relatively quick because the investors who are leaving are those who came with the least capital investment and the least prospect of their own development, easily attracted by subsidies or political agreements.

On the other hand, there are two positive stories in exports. One is the strong growth in service exports – especially ICT (nominally 17% in the first quarter of 2025) – which is in line with the positive trend in FDI inflows to this sector. This inflow, we must emphasize, could only have been encouraged by the protests. But IT services are also exported by domestic companies, which is in line with the second piece of good news. That is the continued growth in goods exports from sectors where Serbian producers are predominantly present – food, metal, plastics industry, wood (furniture and other machinery have been declining lately).

From conversations with these entrepreneurs, we learn that they are managing in conditions of slow European demand by offering competitive goods when European companies are looking for savings, or by turning to markets of former “third world” countries. They are also doing well in the wider region. Of course, this represents a missed opportunity, because domestic production and exports are not only inadequately supported but are discriminated against by tax and subsidy policies, and weak export support that puts them at a disadvantage compared to the competition.

Mortar in Exchange for Exports

It is important that during this period, public investments replaced goods exports as the engine of economic growth. Government investments in 2021 reached 7% of GDP and have since grown fast enough to maintain and even raise that level in 2024. This would be quite alright if it served to raise the productivity of the domestic economy, especially for people with the lowest wages – if their education and on-the-job training were improved, if they were prepared for more complex jobs, or if the infrastructure that foreign factories are abandoning was prepared, with appropriate programs, for domestic SMEs that are desperate for industrial locations.

Investment in road infrastructure was certainly productive in earlier years, when investments filled obvious, urgent needs, and with less haste. However, in recent years, the selection of investment projects has been done without clear criteria, consists of too much cement, not to say mortar, and too little equipment, and it is done at the expense of investing in the state’s capacity to provide adequate support and development services to the economy and citizens.

The collapse of the Novi Sad railway station canopy is not an isolated incident, just as the accident at TENT 3.5 years ago was not an isolated incident, but the tip of the iceberg of delayed or poorly executed investments in EPS and other public enterprises.

Conclusion

For President Vučić, the slowdown in government investments represents a huge problem. Not only does it increase the risk of missing deadlines for the Expo, but, as we have shown here – the key (short-term) driver of economic growth is being lost. And this is happening precisely at a moment when, under conditions of political crisis, the President especially needs to produce results. According to public statements, the President still believes that the lost time can be made up.

For citizens, the problem is that the political elite blames protests for problems it is unable to solve. It is unable to raise the productivity of the economy through investments, because that requires dialogue with it; it is unable to lead them quickly and responsibly, because that requires competent and motivated civil servants. It is unable to see, let alone activate, the potential that lies in the domestic economy – because this requires fair market competition, and again – competent and motivated civil servants, as well as productive and service-oriented public enterprises. It is unable to seize better opportunities that are still opening up in the restructuring European economy – because that requires the work of an entire network of people and competent and motivated civil servants.

In any case, it is better for citizens that economic growth slows down than for some “mother’s sons” to give in under pressure again.

Author: Kori Udovički, Chairwoman of the Board, Director, CEVES

SR

SR